EDUCATION INDUSTRY

Cyber Threats: Top Hackers threatening Higher Education Institutions right now!

Who are these gold miners, and what do they have to gain?

Establishment fees and research and development expenses must be amortized on a straight-line basis over a period of 3 years.

These provisions must be confirmed by the auditor. Extension of the scope of dividend tax to income deemed distributed and other reinstatements into the taxable profit. The tax basis is equal to the sum of reinstatements less income tax.

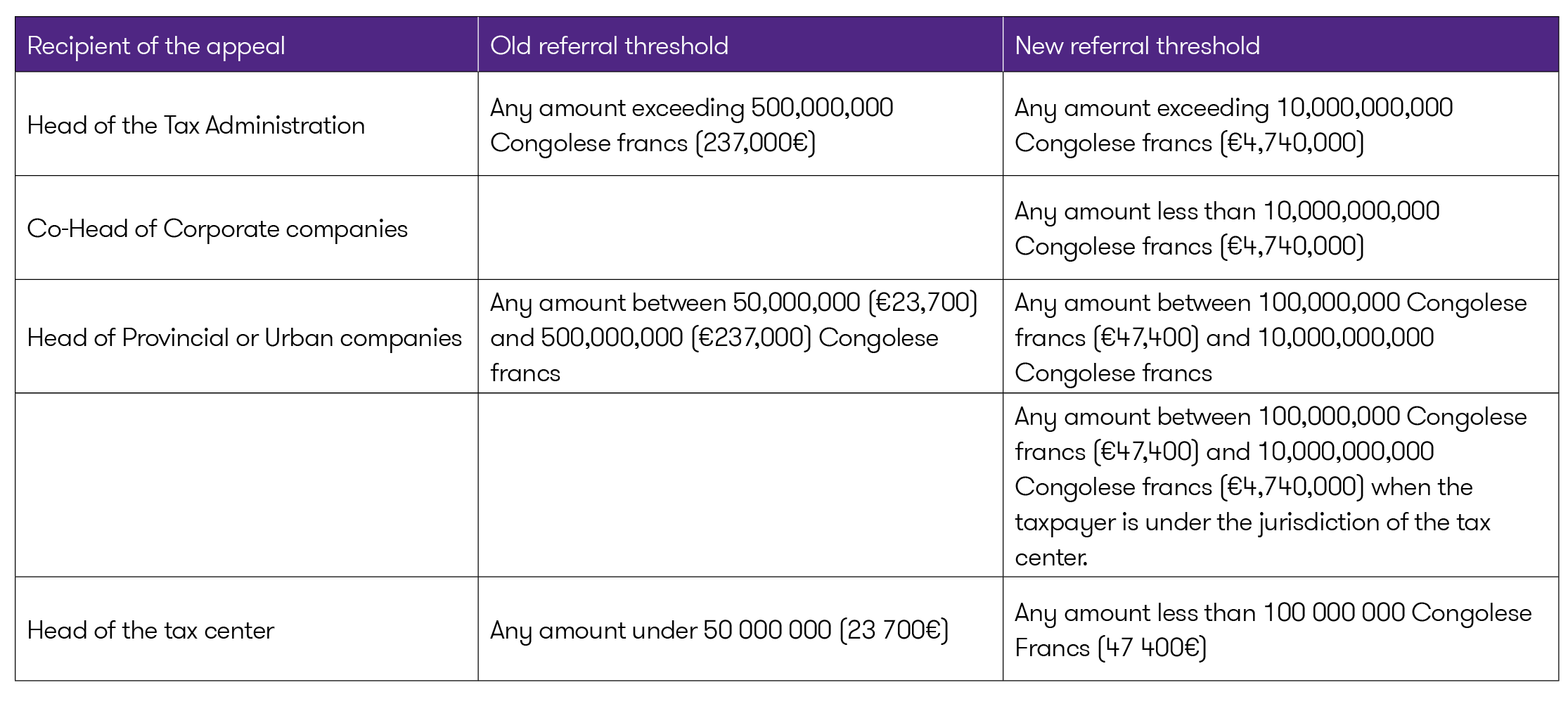

The thresholds for ordering tax relief in the context of a tax claim are now set as follows:

SNG Grant Thornton uses cookies to monitor the performance of this website and improve user experience

To find out more about cookies, what they are and how we use them, please see our privacy notice, which also provides information on how to delete cookies from your hard drive.