In this issue, we compare tariffs by top traded products between South Africa, United States of America, China our biggest trading partner for 2023 and 2024, Germany, Russia, Nigeria,

Botswana, Mozambique and Namibia.

It is important to note that while we compare tariffs in reference to volume of trade, trade between countries is not influenced only by tariffs. Investment in specific areas of interest with mutual benefits, economic growth for one party may benefit a trading partner, closer political tiers etc. (non-tariffs trade enablers/barriers).

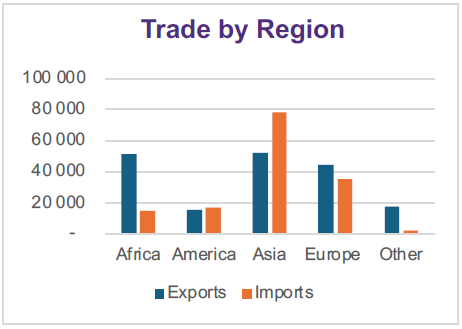

Africa is the biggest market for South African Exports followed by Asia, Europe and America. We unpack below the tariffs imposed on South African products by some of the leading trading partners within these regions.

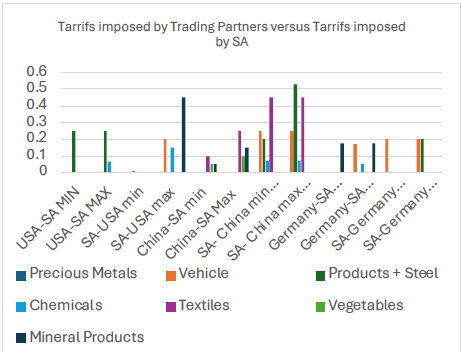

The tariffs below are recorded from min to maximum. This is because levying of tariffs involves different tariff headings from different chapters and sections of the harmonized

schedule making it very difficult to list exact tariffs charged by one trading partner to another. The comparisons below exclude antidumping duties and counter bailing duties.

Certain products belonging to the same product groups can be found in different chapters with different tariff rates being applied (i.e. machinery, depending on composition, product description, and use). Due to limited information available on the exact tariffs charged by each party on products exported and imported we have used the minimum and maximum rates.

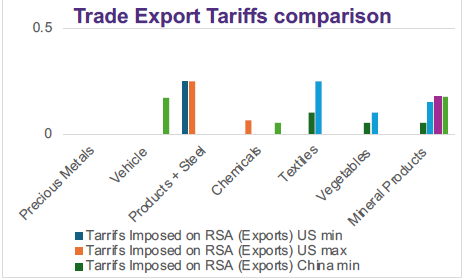

Comments on the Trade Exports Tariffs Comparison Graph:

In general, South Africa imposes higher tariffs than those imposed by trading partners outside of Africa, with highest tariffs imposed on certain steel products imported from China.

South Africa imposes tariffs of 20% on medium to heavy commercial vehicles and 25% on light vehicles imported from America. America does not impose tariffs on South African imported vehicles as these are covered by the African Growth and Opportunity Act trade agreement (AGOA).

Below graph depicts South Africa penetration into global markets with top 10 commodities & consumption by country/region;

South Africa’s primary import partner for various goods remains China. China dominates the import of steel and iron making 52% of South Africa import market and textiles making up 45% of South Africa import market. The higher tariffs charged on Chinese tariffs at 45% (minimum) and 52% (maximum) has not impacted the amount of textiles imported by South African Business or Individuals from China.

Germany is a key supplier of motor vehicles and parts making up 40% (25% tariffs imposed by South Africa) of the import market in South Africa, America makes up 20% (20% tariffs imposed by South Africa) of the import market and China makes 25% ( 25% tariffs imposed by South Africa).

Based on this, tariffs alone can therefore not explain why South Africans are buying less American cars in comparison to German cars or Chinese cars.

Top 10 SA Exports

- Mineral products: Rest of World-ROW @31.6% of R512B, followed by China @28.7%, India @12.5%, Germany @3.26%, & USA@2%.

- Precious Metal: ROW leads @76.8% of R377B, USA 2nd @14.6%, Germany @6%, & China @1.4%.

- Vehicles, aircraft & Vessels: ROW sits top @38% of R276B, Germany 2nd @31.9%, USA @ 12.6%, & India @ 1.9%.

- Products Iron & Steel: ROW sits top @ 35.5% of R207B, China 2nd @ 20.3%, USA @ 10.5%, India @ 1.6%, & Germany @ 1.1%.

- Machinery: ROW leads @ 22.8% of R146B, Germany @ 7.9%, USA @ 6.2%, China @ 0.7%, & India @ 0.6%.

- Vegetables: ROM consumed 57% of R136B, China 2nd @ 5.8%, USA @3.6%, Germany @2.1%, & India @ 1.3%.

- Chemicals: ROM sits top @ 34.6% of R117B, USA @ 8.6%, Germany @ 3.3%, China @ 2.6%, & India @ 2.2%.

- Prepared foodstuffs: ROW tops @ 30.3% of R86.7B, USA 2nd @ 4.9%, Germany @ 2%, China @ 0.9%, & India @ 0.3%.

- Plastic rubber: ROW consumed 18.3% of R35.2B, USA @ 3%, Germany @1.1%, China @0.6%, & India @ 0.4%.

- Wood pulp & paper: India consumed @ 27.7%, China @ 17.1%, ROW @16.5%, USA @ 2%, & Germany @ 0.5%.

Digest & Conspectus, and Contact details

Customs environment (import/export) involves lot of administrative compliance, global trade research and frequent updates, regular updates are required to ensure seamless and cost-effective value chain activities. At SNG Grant Thornton, we offer a detailed health check for cross-border activities compliance status and savings your entity can have through evaluating core areas/topics such as “Trade Agreements & Rules of Origin” etc.