-

Digital and Analytics

We have developed distinctive capabilities in digital advisory and data analytics that are key to the success of dynamic organisations.

-

Business Consulting

Our business consulting services help organisations improve operational performance and productivity throughout the growth life cycle.

-

Corporate Finance & Restructuring

We combine our insights and experience to provide a comprehensive range of advisory and corporate finance and restructuring solutions.

-

Internal Audit

Our internal audit service is designed to provide both assurance and consulting assistance on the adequacy and effectiveness of an organisation’s system of internal controls.

-

Business Risk Services

Our service is focused on enabling broader risk coverage and proactive management of risks for the achievement of organisational strategy.

-

Business Process Solutions

We work with a multitude of organizations to improve their finance function efficiency, reduce costs associated with business processes and provide a complete solution to the challenge faced by South African organizations.

-

Programme Assurance & Advisory

Our aim is to protect shareholder value by providing Assurance and Advisory services on change portfolios and large-scale programmes to assist organisations.

-

Forensic Services

Our forensic capability is integrated with our wider advisory services – not an add-on.

-

Cyber Advisory

Our Cyber Advisory service is designed to help you identify, protect, detect, respond and recover from cyber-attacks.

-

IT Advisory Services

We help clients to navigate the complexities and provide you with robust independent assurance that your IT risks, key management priorities and core systems are being appropriately managed.

-

SNG ARGEN

We have a dynamic actuarial team set to assist businesses to comply with the audit standards where actuarial services are required.

-

General Audit

We provide a sound statutory audit of financial statements specialising in both listed entities and state-owned organisations.

-

Financial Services Group (FSG)

The Financial Services Group (FSG) offers specialised audit and advisory solutions to the banking, treasury and financial services sectors.

-

Technical Excellence

We have a well-established specialized technical division, with in-depth, local and international knowledge and experience, which consists of three units namely; Accounting, Audit and Sustainability reporting.

-

Corporate Tax

We offer your business access to a global network of tax specialists in over 130 countries with extensive corporate tax technical skills to provide meaningful advice and adding value to your organization.

-

Value-Added Tax

We can manage your overall exposure to indirect taxes, guide you through complex South African Value-Added Tax (VAT) legislation.

-

Global Mobility

Taxes can be complicated, but the SNG Grant Thornton approach is to assist the new assignee with a clear and easy process.

-

Customs and Excise Tax

Our Customs and Excise team assist traders with driving cost-effective supply chains while maintaining legitimate trade.

-

Tax Technology

This is the lynchpin of our tax audit and advisory approach in making the tax function of our clients effective in data management tools.

-

International Tax & Transfer Pricing

Our team is ideally suited to serve large multinationals and other global companies that need on the ground expertise in multiple jurisdictions, given our extensive network of offices around the globe.

-

Specific Focus Areas

We have a team of dedicated tax specialists with deep knowledge to bring practical and cost-effective tax solutions to our clients and assist entities operating within these sectors to effectively manage their tax needs.

-

Tax Dispute Resolution (TDR) Services

Taxpayers are experiencing significant increase in number and size of tax audits by SARS which are leaving taxpayers with additional assessments and penalties, sources of tax disputes.

-

Business Consulting

We provide fit-for-purpose solutions to address major challenges the Education sector faces by supporting our clients.

-

Employees’ Tax Services

Its important to ensure that the institution complies with the tax legislation and that all payroll records are accurate and complete.

-

Programme Assurance & Advisory

The need for sound project management and effective solution delivery gives you the edge in competitive markets.

-

Forensic Services

Fraud detection review and forensic investigation for Higher Education

-

Digital and Analytics

The digitalisation of processes within the higher education sector leads to increased data generation. This data can be an essential asset when leveraged correctly.

-

Cyber Security Services

There is no one-size-fits-all security solution to preventing all attacks, but we have cybersecurity strategies that education institutions can use to minimise cyber threats.

-

Sustainable Development Goals (SGDs)

SDG Impact Standards Training Course

- South Africa

- Grant Thornton Morocco

- Grant Thornton Namibia

- Grant Thornton Malawi

- Grant Thornton Gabon

- Grant Thornton Algeria

- Grant Thornton Togo

- Grant Thornton Côte d'Ivoire

- Grant Thornton Zimbabwe

- Grant Thornton Cameroon

- Grant Thornton Zambia

- Grant Thornton Botswana

- Grant Thornton Mauritius

- Grant Thornton Senegal

- Grant Thornton Uganda

- Grant Thornton Nigeria

- Grant Thornton Kenya

Tax risk management needs to be a proactive process. Lacking the appropriate tax expertise can have far-reaching implications for mid-market businesses beyond just financial repercussions. It can also affect their reputation and legal compliance.

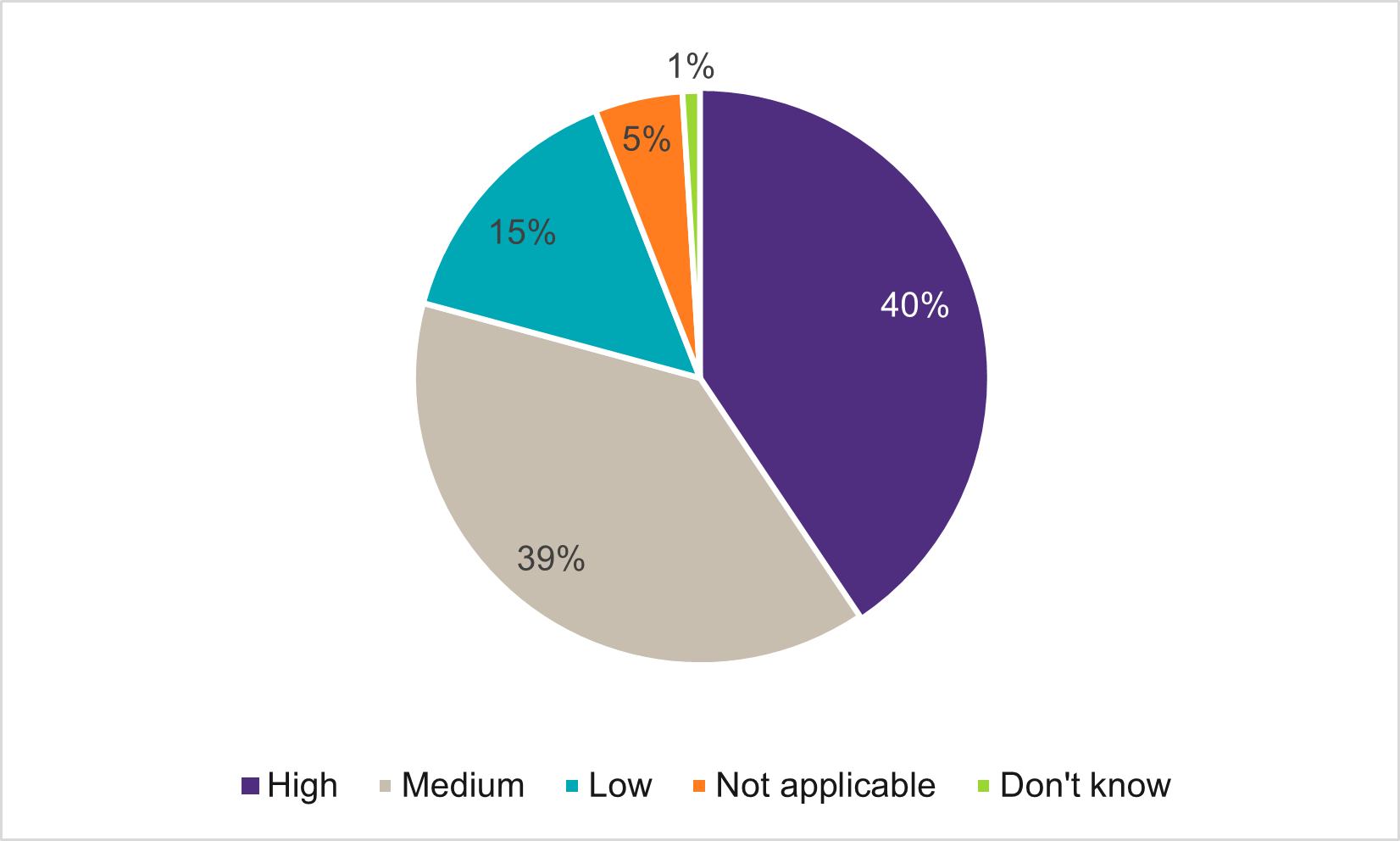

It is important for businesses to ensure that they implement tax strategies in line with their business strategies. In a business market survey for the International Business Report, conducted between August and October 2022, when questioned on the risk of not having the right skillsets, 41% of mid-market businesses agreed that the risk was high, 39% believed the risk was medium, and only 15% said the risk was low.

It is important for mid-market businesses to consider some of the risks of not having the right tax skillsets internally:

- Incorrect tax filings: A lack of tax expertise can lead to incorrect tax filings, resulting in over- or underpayment of taxes and hefty tax penalties.

- Non-compliance with tax laws: Businesses that lack the necessary tax expertise may be unaware of the tax laws and regulations that apply to them, resulting in non-compliance and legal disputes.

- Loss of credibility: Errors in tax filings can undermine a business’ credibility and erode its reputation among stakeholders such as investors, customers, and partners.

- Responding to enquiries: Inability to effectively respond to tax audits and government agency enquiries.

- Missed opportunities: Businesses without tax expertise may miss out on tax-saving opportunities, which could negatively impact their financial performance.

Outsourcing tax advisory and/or compliance services does not necessarily mitigate the inherent tax risks. In fact, when considering outsourcing, it is more important for the necessary skill sets to be present internally. Ryan Smit, Director – Business Process Solutions

If outsourcing is being considered and the internal skillset is not at the required level, the business may be exposed to further risks, such as:

- Complex, expensive, and non-compliant tax structures

- Lack of transparency regarding specific tax statuses

- Unplanned and unexpected tax consulting fees

- Lack of data ownership.

Tax management has a direct impact on any business’ cash flow which is why a proactive approach is needed. Work towards establishing an internal team and an external advisory team that can assist with some of the regular compliance deadlines, but also provide support on bigger transactions such as mergers, acquisitions, and transfer pricing.

SNG Grant Thornton Tax team has vast experience in providing tax services to businesses.