-

Digital and Analytics

We have developed distinctive capabilities in digital advisory and data analytics that are key to the success of dynamic organisations.

-

Business Consulting

Our business consulting services help organisations improve operational performance and productivity throughout the growth life cycle.

-

Corporate Finance & Restructuring

We combine our insights and experience to provide a comprehensive range of advisory and corporate finance and restructuring solutions.

-

Internal Audit

Our internal audit service is designed to provide both assurance and consulting assistance on the adequacy and effectiveness of an organisation’s system of internal controls.

-

Business Risk Services

Our service is focused on enabling broader risk coverage and proactive management of risks for the achievement of organisational strategy.

-

Business Process Solutions

We work with a multitude of organizations to improve their finance function efficiency, reduce costs associated with business processes and provide a complete solution to the challenge faced by South African organizations.

-

Programme Assurance & Advisory

Our aim is to protect shareholder value by providing Assurance and Advisory services on change portfolios and large-scale programmes to assist organisations.

-

Forensic Services

Our forensic capability is integrated with our wider advisory services – not an add-on.

-

Cyber Advisory

Our Cyber Advisory service is designed to help you identify, protect, detect, respond and recover from cyber-attacks.

-

IT Advisory Services

We help clients to navigate the complexities and provide you with robust independent assurance that your IT risks, key management priorities and core systems are being appropriately managed.

-

SNG ARGEN

We have a dynamic actuarial team set to assist businesses to comply with the audit standards where actuarial services are required.

-

General Audit

We provide a sound statutory audit of financial statements specialising in both listed entities and state-owned organisations.

-

Financial Services Group (FSG)

The Financial Services Group (FSG) offers specialised audit and advisory solutions to the banking, treasury and financial services sectors.

-

Technical Excellence

We have a well-established specialized technical division, with in-depth, local and international knowledge and experience, which consists of three units namely; Accounting, Audit and Sustainability reporting.

-

Corporate Tax

We offer your business access to a global network of tax specialists in over 130 countries with extensive corporate tax technical skills to provide meaningful advice and adding value to your organization.

-

Value-Added Tax

We can manage your overall exposure to indirect taxes, guide you through complex South African Value-Added Tax (VAT) legislation.

-

Global Mobility

Taxes can be complicated, but the SNG Grant Thornton approach is to assist the new assignee with a clear and easy process.

-

Customs and Excise Tax

Our Customs and Excise team assist traders with driving cost-effective supply chains while maintaining legitimate trade.

-

Tax Technology

This is the lynchpin of our tax audit and advisory approach in making the tax function of our clients effective in data management tools.

-

International Tax & Transfer Pricing

Our team is ideally suited to serve large multinationals and other global companies that need on the ground expertise in multiple jurisdictions, given our extensive network of offices around the globe.

-

Specific Focus Areas

We have a team of dedicated tax specialists with deep knowledge to bring practical and cost-effective tax solutions to our clients and assist entities operating within these sectors to effectively manage their tax needs.

-

Tax Dispute Resolution (TDR) Services

Taxpayers are experiencing significant increase in number and size of tax audits by SARS which are leaving taxpayers with additional assessments and penalties, sources of tax disputes.

-

Business Consulting

We provide fit-for-purpose solutions to address major challenges the Education sector faces by supporting our clients.

-

Employees’ Tax Services

Its important to ensure that the institution complies with the tax legislation and that all payroll records are accurate and complete.

-

Programme Assurance & Advisory

The need for sound project management and effective solution delivery gives you the edge in competitive markets.

-

Forensic Services

Fraud detection review and forensic investigation for Higher Education

-

Digital and Analytics

The digitalisation of processes within the higher education sector leads to increased data generation. This data can be an essential asset when leveraged correctly.

-

Cyber Security Services

There is no one-size-fits-all security solution to preventing all attacks, but we have cybersecurity strategies that education institutions can use to minimise cyber threats.

-

Sustainable Development Goals (SGDs)

SDG Impact Standards Training Course

- South Africa

- Grant Thornton Morocco

- Grant Thornton Namibia

- Grant Thornton Malawi

- Grant Thornton Gabon

- Grant Thornton Algeria

- Grant Thornton Togo

- Grant Thornton Côte d'Ivoire

- Grant Thornton Zimbabwe

- Grant Thornton Cameroon

- Grant Thornton Zambia

- Grant Thornton Botswana

- Grant Thornton Mauritius

- Grant Thornton Senegal

- Grant Thornton Uganda

- Grant Thornton Nigeria

- Grant Thornton Kenya

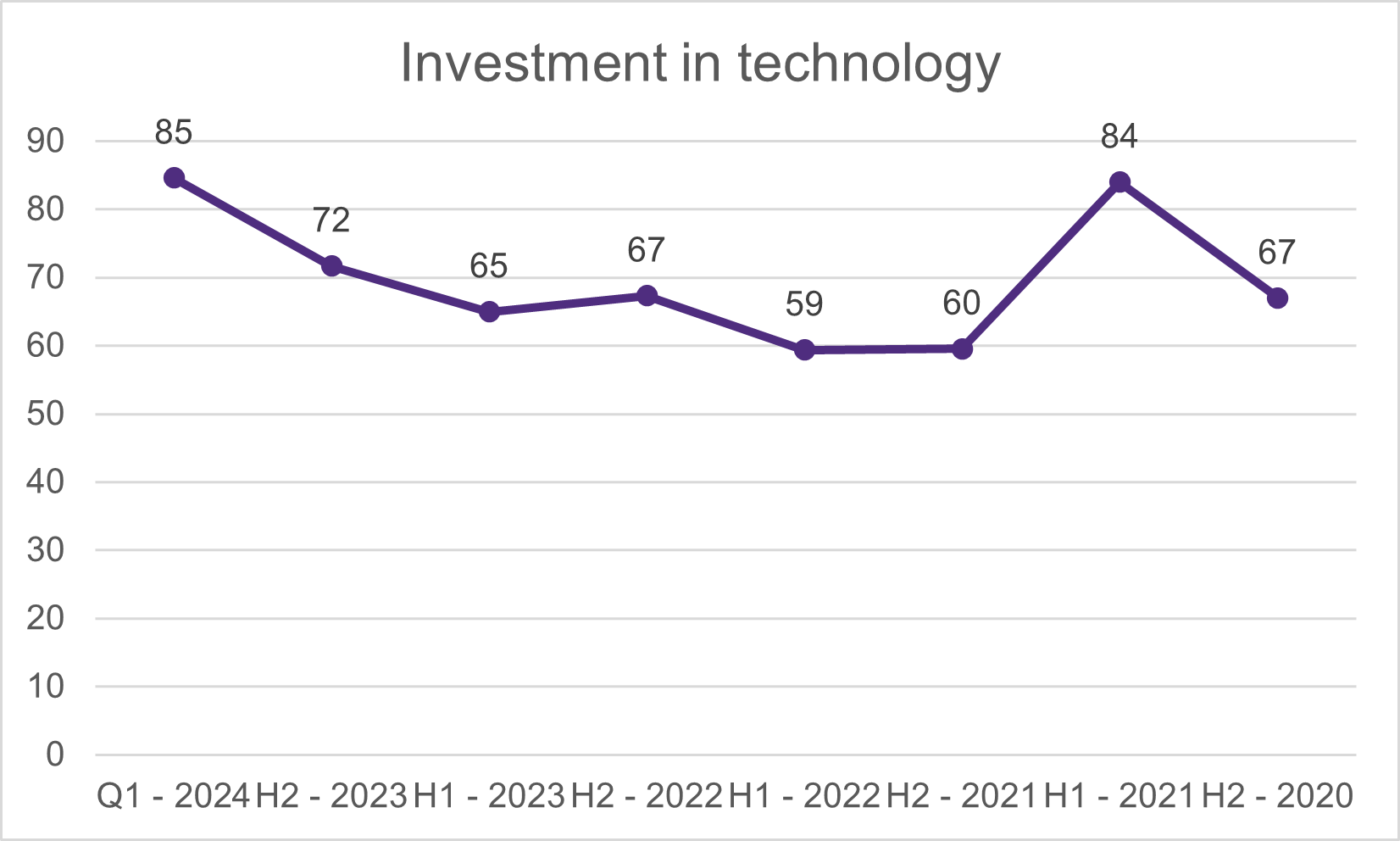

Considering investment intentions, mid-market businesses express a strong interest in investing in technology, with expectations of increased investment compared to the previous period.

Technology investments and the impact of digitisation

In the dynamic landscape of South African mid-market businesses, the latest survey data from GTIL for IBR Q1 2024 unveils intriguing trends regarding technology investments and the impact of digitisation.

Trends in technology investment:

The survey reveals a strong commitment among mid-market businesses in South Africa to bolster their technological capabilities. When asked about their plans to maintain or increase investments in technology, a significant proportion of respondents expressed intentions across the following domains:

Purchasing/upgrading software: A notable 74% of mid-market businesses in South Africa are inclined towards investing in software, indicating a recognition of its pivotal role in modern operations.

Cybersecurity tools: With 61% of respondents prioritising investments in cybersecurity tools, it is evident that mid-market businesses are keenly aware of the importance of safeguarding digital assets in an increasingly interconnected world.

Investing in Artificial Intelligence (AI): 63% of respondents plan to invest in AI, highlighting the growing acknowledgement of AI's potential to drive automation and enhance decision-making processes.

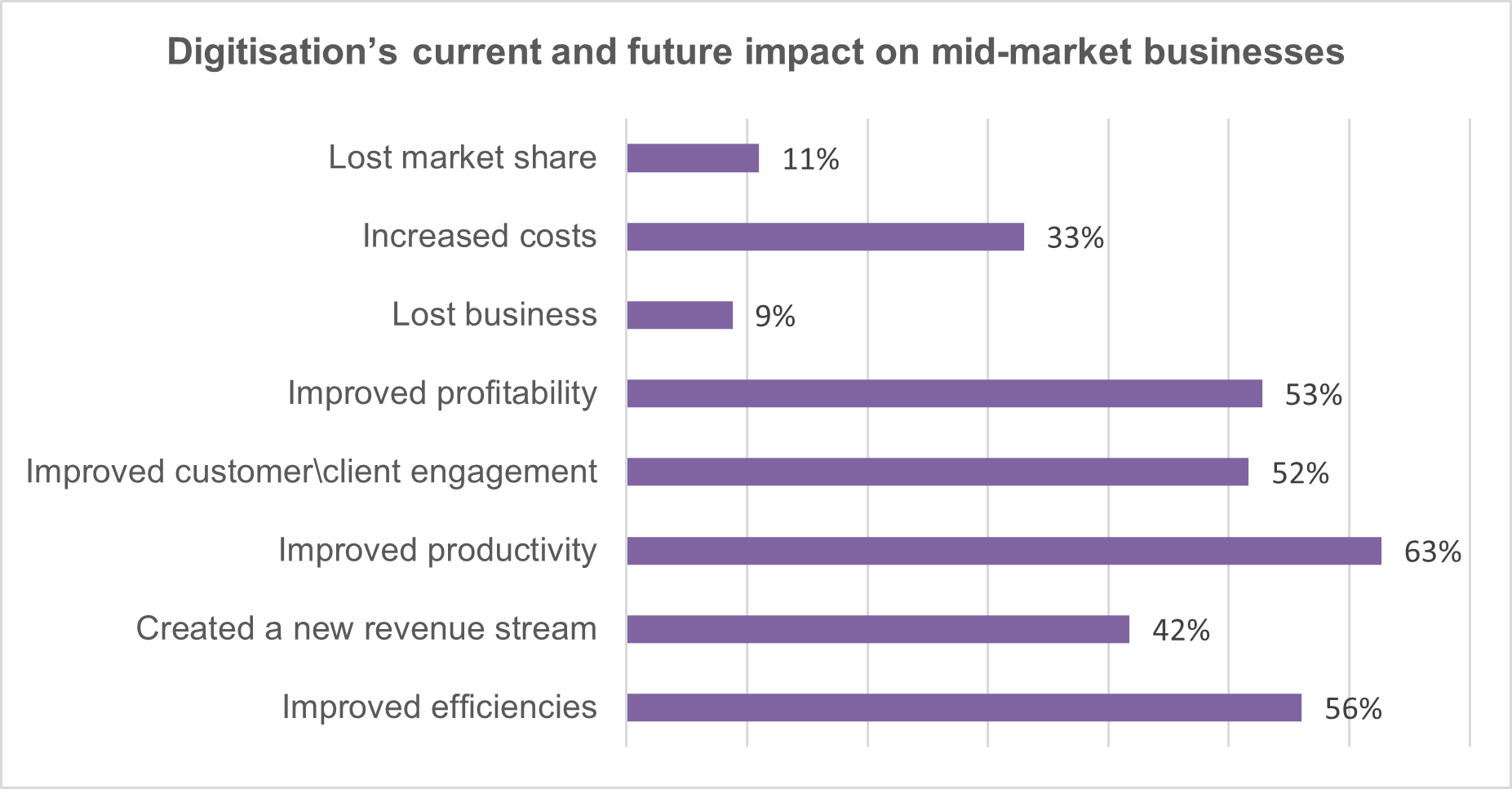

Impact of digitisation:

The survey also sheds light on the tangible impacts of digitisation on mid-market businesses and their anticipated future implications:

Improved efficiencies and productivity: For both indicators respectively, the majority of respondents reported enhancements in efficiencies (56%) and productivity (63%)due to digitisation, indicating its role in streamlining operations and boosting output.

Enhanced customer engagement and profitability: Digitisation has facilitated better customer/client engagement for 52% of respondents, while 53% reported improved profitability, underscoring the transformative potential of digital technologies in driving revenue growth.

Challenges and opportunities: Despite the benefits, challenges such as increased costs (33%) and lost business (9%) were reported. However, these challenges are likely to be outweighed by the opportunities presented by digitisation in the long term.

The survey underscores the strategic imperative for South African mid-market businesses to embrace technology as a driver of innovation and competitiveness. By prioritising investments in software, cybersecurity, and AI, while leveraging the benefits of digitisation, mid-market businesses can navigate the evolving landscape with resilience as well as unlock new avenues for growth and success.

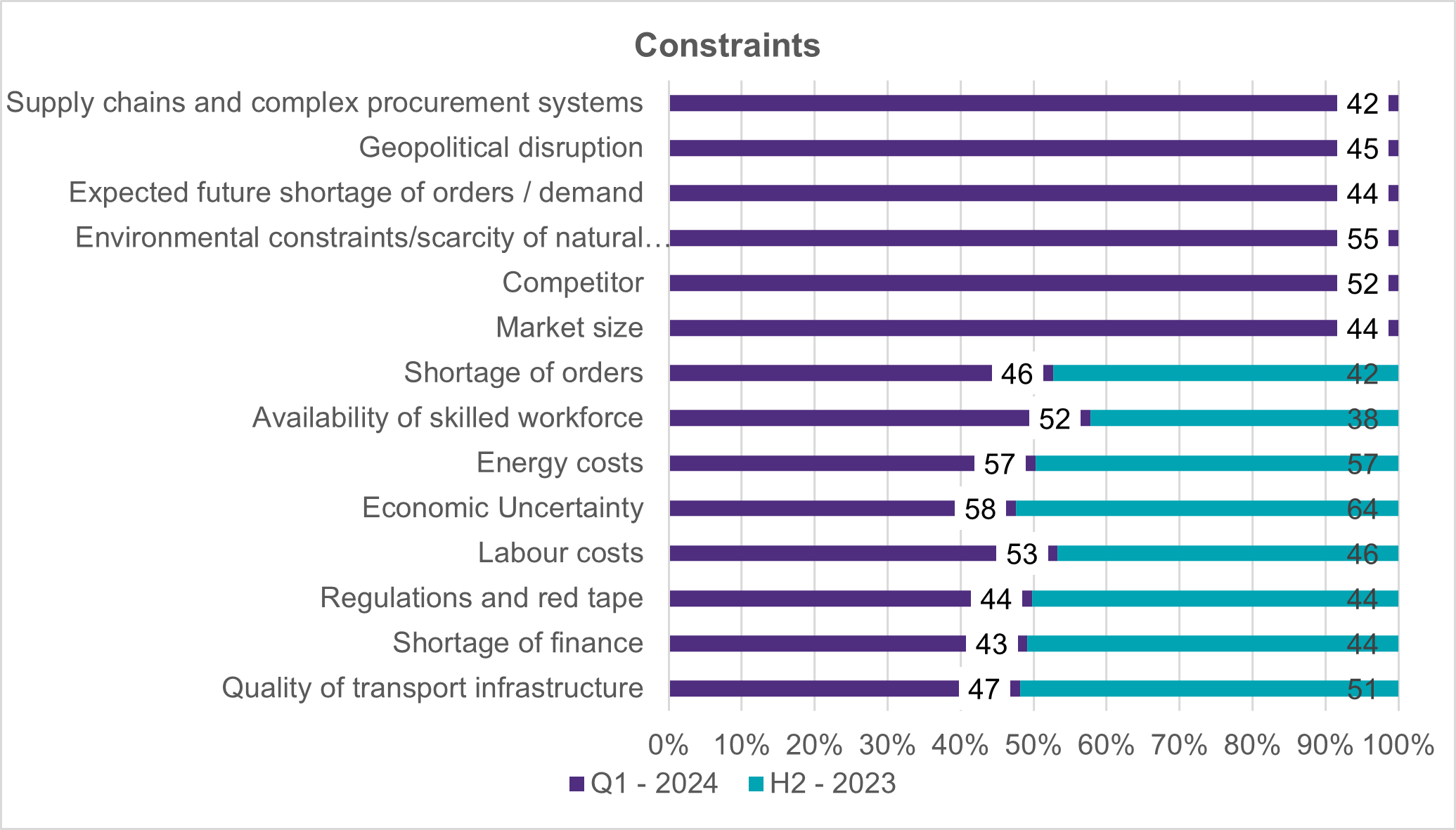

According to IBR data, mid-market businesses are focusing on many areas during this time. There is a significant concern about red tape (27%), strengthening infrastructure (49%), and making it easier to do business (45%).

Mid-market businesses would like to see government processes and rules made simpler and more efficient. However, despite these desires for business-friendly reforms, fears about political instability due to coalition arrangements (31%) cast a shadow over economic prospects. The possibility of shifting political alignments and potential policy uncertainty following the elections may pose challenges for mid-market businesses in terms of planning, investment, and decision-making. Mid-market businesses understand the importance of stable governance and clear policy frameworks in maintaining investor confidence and driving long-term economic growth.

Despite these changes, mid-market businesses expect stronger monitoring (57%) and policy formulation (60%) to handle the changing environment. Transparent governance processes and effective policymaking are critical for ensuring regulatory clarity, mitigating market inefficiencies, and levelling the playing field for businesses of all sizes. Furthermore, proactive and forward-thinking policies can assist mid-market businesses in adapting to market dynamics, capitalising on opportunities, and mitigating risks in an increasingly globalised and competitive world.

The IBR also throws light on significant constraints, identifying major areas of concern. The anticipation of transport infrastructure has declined to 47 in Q1 2024 from 51 in H2 2023, a lack of funding slightly decreased from 44 in H2 2023 to 43 in Q1 2024, and regulatory constraints remained at 44 in both periods, these are significant obstacles. Furthermore, employment expenses are expected to increase to 53 in Q1 2024 from 46 in H2 2023 and economic uncertainty expectation has reduced from 64 in H2 2023 to 58 in Q1 2024, there are constant difficulties influencing corporate operations. These constraints highlight the multiple challenges mid-market businesses would face when navigating the operating environment, which ranges from obtaining proper capital and skilled talent to dealing with regulatory challenges and market uncertainty.

Despite these challenges, mid-market businesses are well-positioned to adapt and capitalise on possibilities arising from infrastructure investments and policy reforms, while also managing risks associated with political uncertainty and economic volatility. Mid-market businesses that use their resilience, agility, and strategic foresight may navigate the difficulties of an election year and contribute to long-term economic growth and development.