IT Governance

Popular topics

Featured insights

Insights

MINING TAX | CIT

Capability Statement 2024

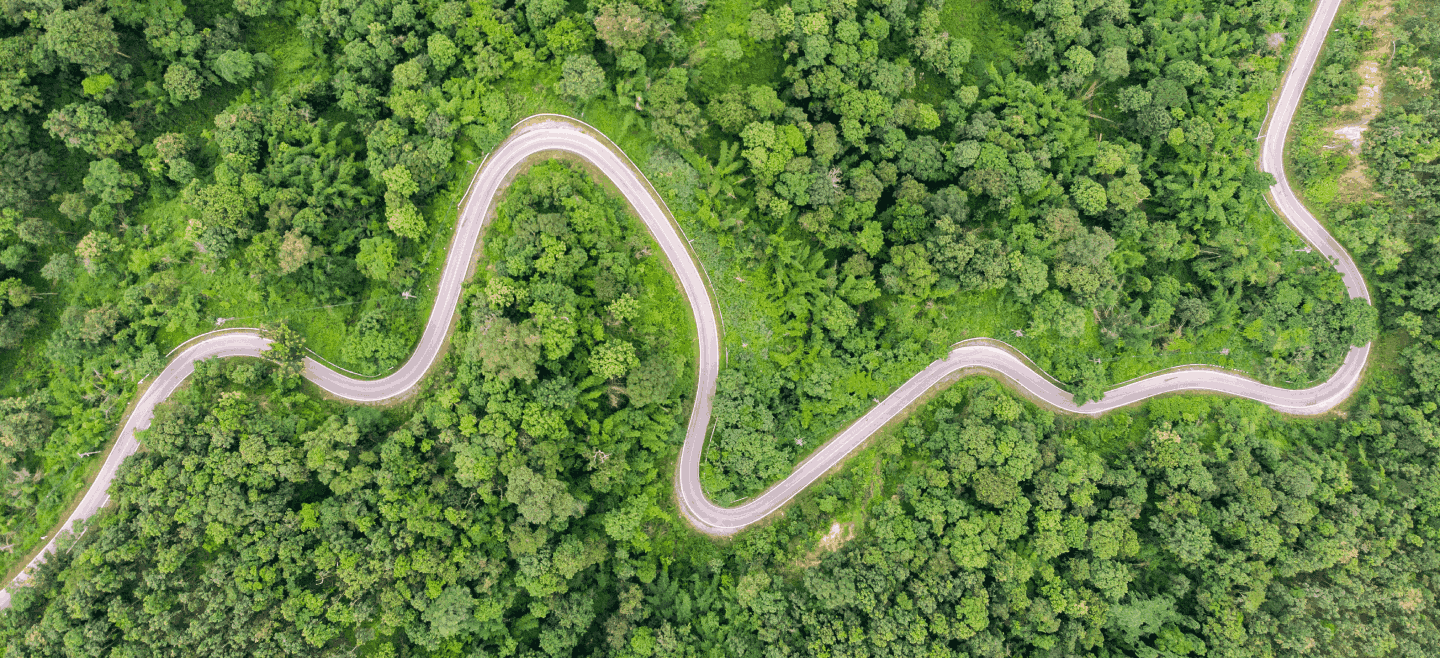

Navigating through complex and often uncertain mining tax laws

MINING TAX | CUSTOMS & EXCISE

Capability Statement 2024

Navigating the complexity of the Mining Tax Laws and Incentives

Cybersecurity

The future of cybersecurity by MTN

In today's digital world, robust cybersecurity practices are crucial.

Africa Tax Desk

Uganda's Proposed Amendments in Tax Laws

Recently, GT Uganda in partnership with ENS Africa hosted the FY 2024/2025 conference covering proposed tax amendments.

Africa Tax Desk

Nigeria's Transfer Pricing Returns & CbCR Notifications - Migration from E-TP Plat to Tax Promax

The migration of the filing of Transfer Pricing (TP) Returns (TP Declaration & TP Disclosure) and Country-By-Country Reporting Notification in Nigeria, from the E-TP Plat to Tax Promax Platform is a welcome development.

Tax Focus

Two Pot Retirement System

This new system will apply to all retirement funds, that is, both private sector and public sector funds.

Draft Amendments Rules

Customs and Excise Act - No.91 of 1964

SARS Excise division has published a second draft relating to creating a new warehousing type.

A Shift in South Africa’s Approach on Transfer Pricing Disputes

ABD LIMITED V CSARS, TAX COURT, CASE NO IT 14302

A recent ruling by the Tax Court in the case of ABD Limited v CSARS marked a notable shift in how South Africa approaches disputes over transfer pricing.

Tax disputes

Consideration of remedies other than objection and appeal

This article deals with remedies other than objection and appeals that are at taxpayers’ disposal to challenge assessments raised or decisions made by SARS.

Strengthening Cyber Security

The crucial role of Internal Audit

The role of Internal Audit in enhancing Cybersecurity

Addressing Cybersecurity Challenges in 2024

Strategies and Recommendations

Implementing these strategies is crucial for organizations to bolster cybersecurity defenses and combat evolving threats.

BUSINESS RISK SERVICES

Internal Audit and Programme Assurance

The continued tragic failure rate of Projects requires Internal Audit to be part of the solution and not bystanders.

Cybersecurity Insurance:

Are you cyber insurable?

Cybersecurity insurance emerges as a crucial tool, offering protection against various cyber incidents.

SOUTH AFRICAN BUSINESS PULSE

Anticipating how election dynamics and business optimism will impact each other

Mid-market businesses in SA anticipate challenges and opportunities in the next year, influenced by economic factors and the upcoming 2024 general elections.